Stamp Duty Calculator Second Home Main Residence

Mobile homes caravans and houseboats are exempt.

Stamp duty calculator second home main residence. Second homes will attract an additional surcharge even if they are not let out. You can also check out our stamp duty calculator page to see what the stamp duty would be on your main residence where the additional amount is not due. The amount charged depends on a number of factors including the type of property. On sale it is a matter of fact as to whether it is the main residence.

This will calculate the new rate of sdlt you will need to pay after 1st april 2016. The original home must be sold within 3 years. If you sell or give away your previous main home within 3 years of buying your new home you can apply for a refund of the higher sdlt rate part of your stamp duty bill. Here s everything you need to know.

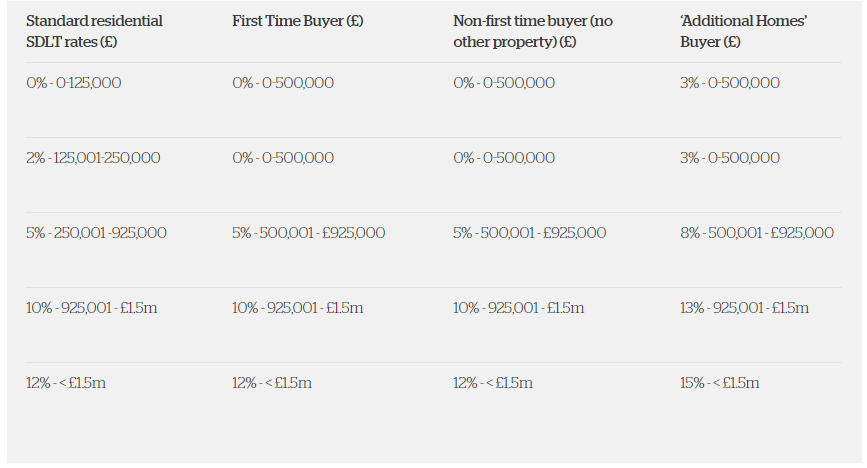

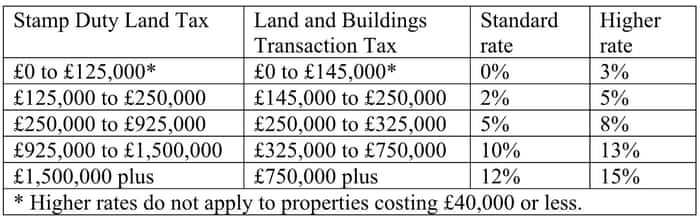

It can make a huge difference in the amount of stamp duty payable particularly on higher value properties depending on whether it is classed as a main residence purchase or replacement or a second home purchase. There are two levels of stamp duty for standard residential stamp duty purchases in the uk. Stamp duty for second homes also attracts a 3 percent surcharge from april 2016. Stamp duty refunds are available for home movers replacing their main residence.

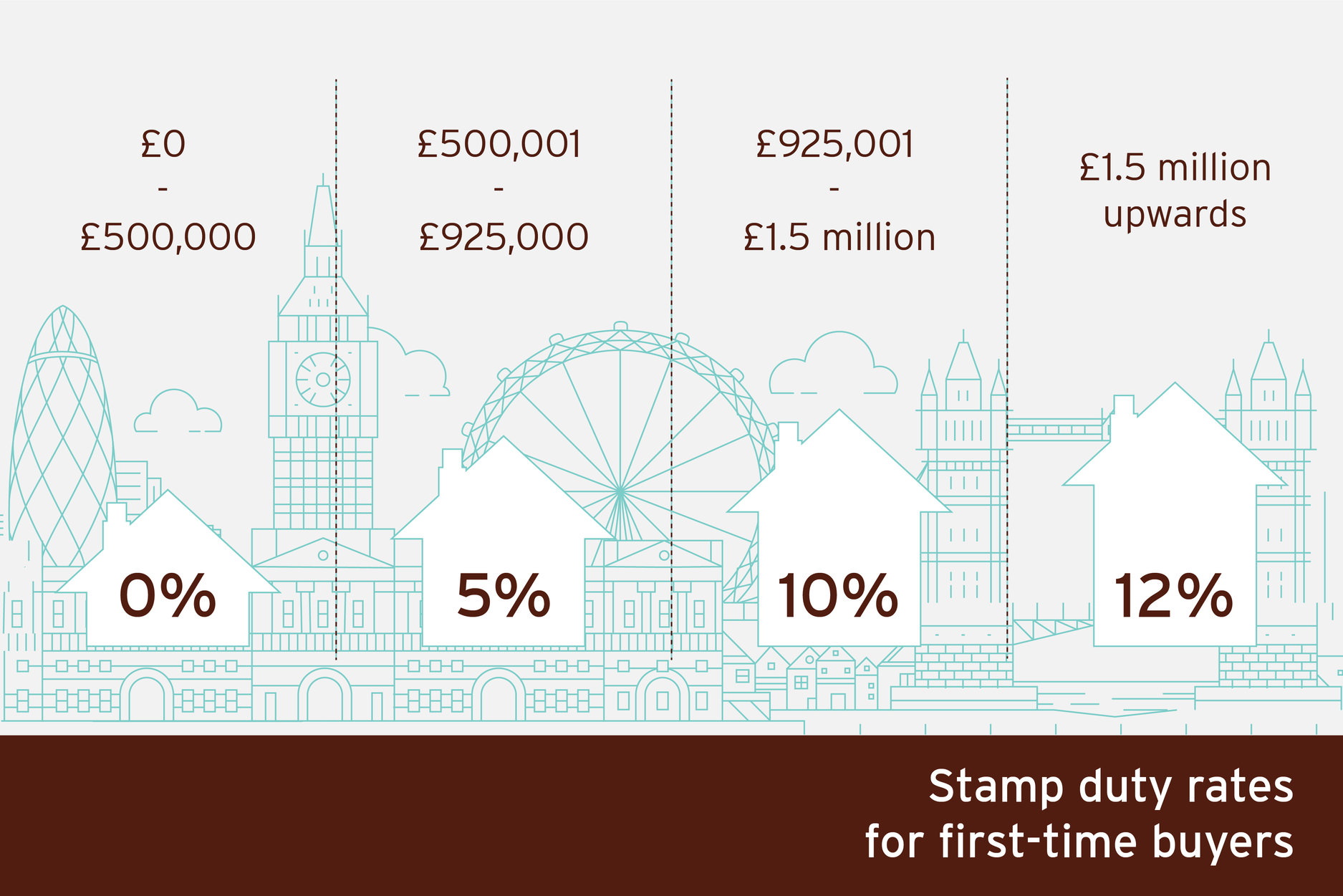

The land tax usually applies to those buying properties over 125 000 in value with the exception of first time buyers who only pay stamp duty on propertys worth over 300 000. Stamp duty is a tax that is paid whenever you buy land or property. Since april 2016 there has been an additional rate of stamp duty for second homes. Stamp duty two levels.

You cannot get a refund if. With a much lower starting threshold of 40 000 most second home purchases now attract an additional 3 stamp duty tax. Use our buy to let stamp duty calculator by ticking the second home or buy to let option. Because stamp duty is tiered see below table you will pay a different stamp duty rate on different portions of the property value.

The higher rates of stamp duty should not apply if someone decides to move house. In this article we are looking at uk main residence stamp duty. You can claim a discount relief if you buy your first home before 8 july 2020 or from 1 april 2021. The old main residence will count as such if it is the individuals main residence at the point of sale or at some time during the period of 3 years before the purchase subject as below.

If you re buying your first home. Moving house replacing a main residence.

.jpeg)